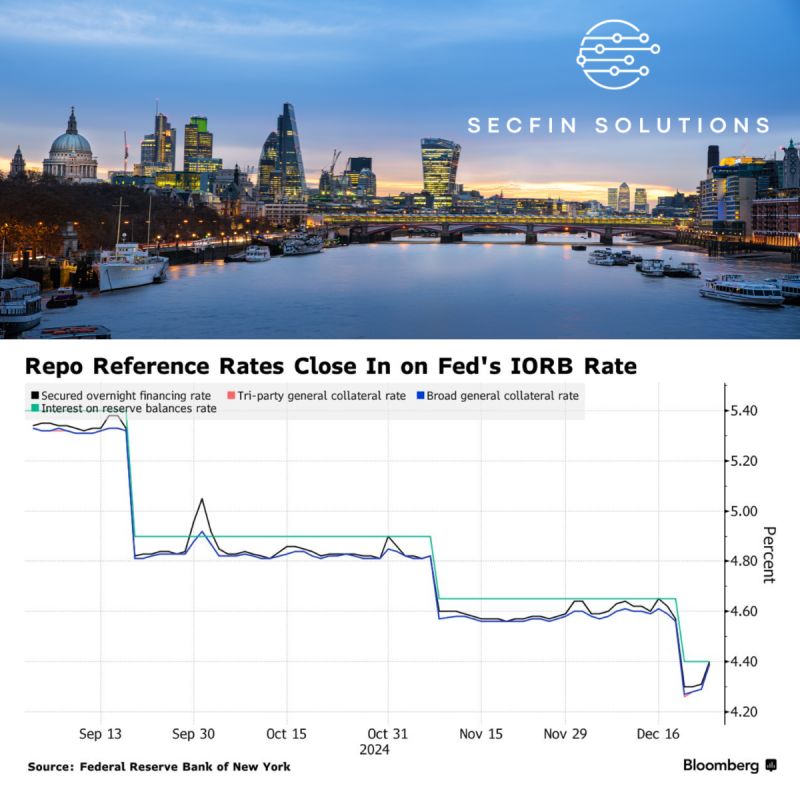

As the year draws to a close, volatility in the US repo markets is back in the spotlight, despite the Federal Reserve Board’s recent adjustments aimed at keeping funding markets stable. The Secured Overnight Financing Rate (SOFR), a key benchmark for one-day lending in the repurchase agreement market, rose to 5.40% as of December 24th. This comes as banks grapple with year-end balance sheet constraints, which have driven up the cost of overnight funding.

The Federal Reserve’s strategy included reducing the rate on its overnight reverse repurchase agreement (RRP) facility by five basis points. The goal? To bring short-term rates closer to the Fed’s offering level and ensure smoother operations during the typically volatile year-end period. However, data suggests that other key repo rates, such as the Tri-Party General Collateral Rate and the Broad General Collateral Rate, have also increased, reflecting persistent challenges.

Year-end funding pressures are not new, but this period carries heightened significance as the market scrutinises whether these fluctuations signal broader issues in the financial system. Notably, Fed officials, including New York Fed President John Williams, have warned of volatility akin to the spike seen at the end of September.

To address these challenges, the Federal Reserve Bank of New York has doubled its Standing Repo Facility (SRF) operations for the days surrounding year-end. By offering additional access to cash through Treasury and agency debt exchanges, the Fed aims to temper volatility. However, some market participants question the effectiveness of these measures, citing limitations within the current framework.

The interplay between quantitative tightening—where the Fed continues to unwind its balance sheet—and rising rates adds complexity to an already delicate situation.

For those in the financial ecosystem, this is a crucial moment to assess the balance between liquidity and stability. The widening spread between the interest on reserve balances (IORB) and repo rates underscores ongoing excess supply in bank reserves—a key indicator of how far quantitative tightening can realistically go.

As 2025 approaches, the repo market’s behaviour will remain a barometer for broader economic stability. While the Fed’s interventions may mitigate some pressures, the question remains: how resilient is the market to sustained tightening and shifting dynamics?

I’m working on a paper on the spread between CLEARED and UNCLEARED repo. If you’d like to contribute please DM me.

Thanks to Alexandra Harris at Bloomberg for her excellent column.

SecFin Solutions Education and Consulting Services

https://lnkd.in/dfQyAQpZ

Understanding the New Era of Mandatory Clearing in U.S. Treasuries

https://lnkd.in/eBtdzizD

AI and the Future of Securities Finance

https://lnkd.in/e5faRPtN

At SecFin Solutions, Glenn Handley epitomises expertise and innovation in global finance and management consulting.

Sign up to hear about our services and stay updated with the latest insights. Please enter your email address.

Access Specialised Training and Consulting Services Designed to Boost Your Financial Acumen and Success