Alan Taylor, a new external member of the Bank of England‘s Monetary Policy Committee (MPC), delivered his first speech yesterday as an MPC member that shifted market views on short-term interest rates. His comments, coupled with a surprisingly low inflation release, suggest significant changes could be on the horizon for monetary policy.

Taylor highlighted the need for a “more accelerated pace of rate cuts” to support the UK’s weakening economy, indicating that rates could fall by 1.25–1.5 percentage points in the next year. This represents a stark departure from the MPC’s gradual approach, which had previously signalled only four quarter-point cuts by the end of 2025.

Why This Matters Now:

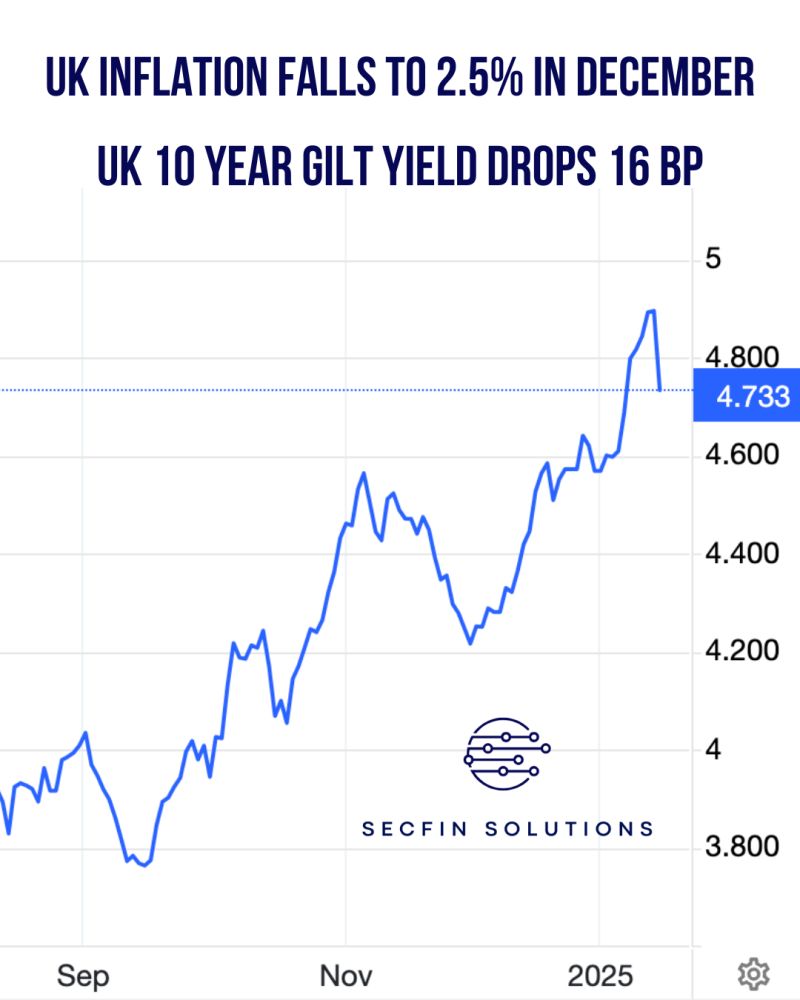

📉 Inflation Undershoots Expectations: For the first time in a long while, headline inflation came in lower than expected, dropping to 2.5%. This marks a key turning point, with services price growth also easing sharply in December.

📈 Gilt Yields Fall: The market reaction was swift. Ten-year gilt yields dropped 16 basis points yesterday, providing some much-needed relief for Chancellor Rt Hon Rachel Reeves and the British government, whose fiscal plans depend on stabilising borrowing costs.

Taylor’s remarks underscore the MPC’s growing concern about the economic outlook. He warned of the risks posed by stalling GDP, loosening labour markets, and deteriorating business confidence, calling for swift action to secure a “soft landing” for the UK economy.

A Critical Turning Point for Monetary Policy

This new stance could signal the end of the prolonged high-rate environment. While the BoE has been cautious in its approach, Taylor’s comments suggest that a faster response may be required to prevent the UK economy from slipping into recession.

The implications for businesses, households, and policymakers are significant. Falling rates could ease pressure on cash flows, mortgages, and employer costs, but uncertainty remains. Will the BoE act quickly enough, and how will markets respond to this changing narrative?

Supporting Businesses Through Uncertainty

At SecFin Solutions, we help organisations navigate economic uncertainty with strategic insights and tailored solutions. Whether it’s assessing the impact of rate changes, optimising financial strategies, or preparing for shifts in the macroeconomic environment, we’re here to help you stay ahead.

The next 12 months will be pivotal for the UK economy. If you’d like to discuss how these developments might affect your organisation, let’s connect.

Read more in today’s Financial Times. I used an article by Sam Fleming Delphine Strauss in this post.

SecFin Solutions Education and Consulting Services

https://lnkd.in/dfQyAQpZ

Want to be notified about all my posts? Ring my bell 🔔

At SecFin Solutions, Glenn Handley epitomises expertise and innovation in global finance and management consulting.

Sign up to hear about our services and stay updated with the latest insights. Please enter your email address.

Access Specialised Training and Consulting Services Designed to Boost Your Financial Acumen and Success